Updated 2 min read

Hipgnosis shares soar as Blackstone bid raises prospect of bidding war

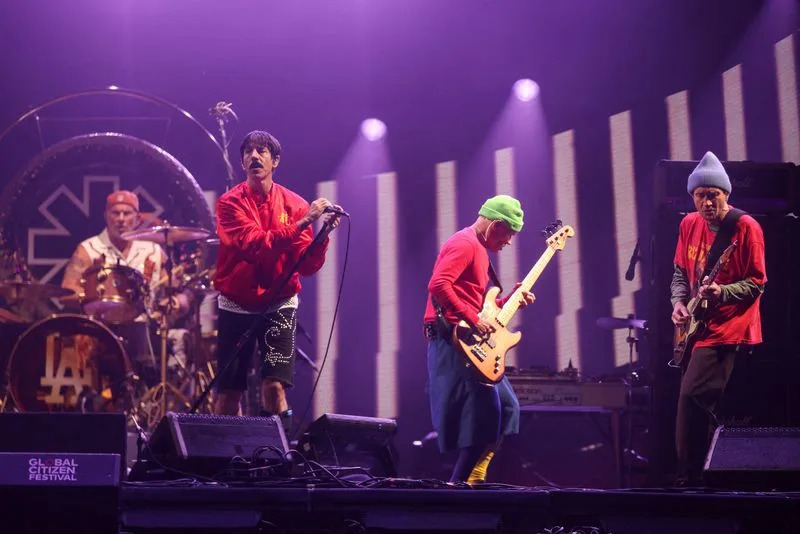

2023 MTV Video Music Awards in Newark

In this article:

SONG

+100.00%

HPGSF

-6.74%

By Yadarisa Shabong and Prerna Bedi

(Reuters) -Shares of Hipgnosis Songs Fund soared as much as 20% on Monday after Blackstone proposed to buy the owner of music rights by artists including Shakira and Blondie for about $1.5 billion, outbidding Apollo-backed Concord.

Blackstone’s fourth and latest proposal over the weekend valued Hipgnosis at $1.24 per share in cash, above last week’s agreed bid from Concord of $1.16 a share.

Hipgnosis shares were trading nearly 12% higher at 1.02 pounds ($1.26) by 1349 GMT, above Blackstone’s proposed price, suggesting that investors were expecting the proposal will trigger a bidding war for the London-listed firm.

The music rights investment firm said it would endorse Blackstone bid if the world’s largest private equity firm were to table a formal offer.

A Blackstone deal would see more than 65,000 songs including tracks by Red Hot Chili Peppers and Neil Young, added to Blackstone’s portfolio, which includes songs by Justin Bieber and Justin Timberlake.

Hipgnosis Songs Fund, founded by industry veteran and former CEO Merck Mercuriadis, launched a strategic review last year after a shareholder vote against the continuation of the fund led to a board overhaul, a portfolio revaluation, and a dispute with its investment adviser over a call option.

The fund’s investment adviser Hipgnosis Songs Management (HSM), which manages artists and songwriters on behalf of the fund and is majority owned by Blackstone, holds an option to buy Hipgnosis’ portfolio of songs if their investment advisory agreement (IAA) was terminated.

Hipgnosis had in the past few months asked HSM to drop the call option from the agreement, but HSM has refused.

The private equity giant’s proposal to buy Hipgnosis is independent of HSM.

Hipgnosis Chairman Robert Naylor last week asked HSM and Blackstone to agree a termination of the IAA, as part of the Concord deal.

HSM said on Monday it would use its right to exercise the call option if Hipgnosis purported to terminate the IAA or hand over HSM’s responsibilities under the IAA to a third party.

($1 = 0.8124 pounds)

(Reporting by Prerna Bedi and Yadarisa Shabong in Bengaluru; Editing by Sherry Jacob-Phillips and Tomasz Janowski)